IR情報IR

Corporate Governance

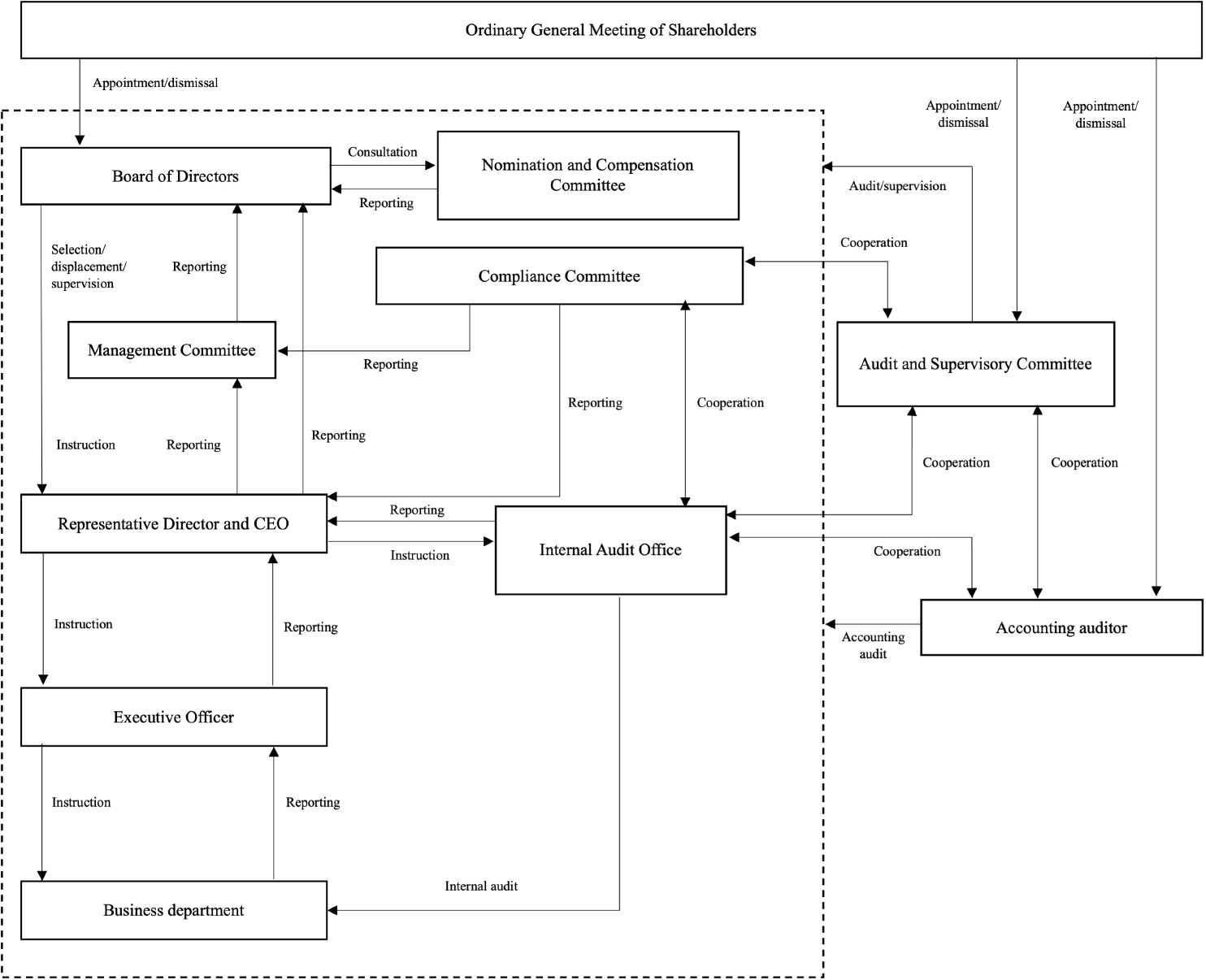

ANYCOLOR Inc. (the “Company”) seeks to earn the trust of its stakeholders, including its shareholders, customers, employees, and business partners, meet their expectations, and increase its corporate value on an ongoing basis. To this end, we recognize the utmost importance of establishing corporate ethics and social confidence based on legal and regulatory compliance. With our sights set on persistently increasing corporate value, we will streamline our operations by taking an accelerated approach to decision-making, while also strengthening our corporate governance practices through efforts that entail building an organizational structure focused on ensuring managerial transparency and impartiality, managing risk, and enhancing the supervisory function.

The Company has adopted a company with an Audit and Supervisory Committee as its corporate structure, and the Audit and Supervisory Committee Members, who are primarily responsible for auditing the performance of the job duties of Directors, hold voting rights in Board of Directors meetings. The structure strengthens the monitoring system of the Board of Directors and realizes enhanced corporate governance.

In addition, as the corporate governance system, the Company uses the executive officer system in addition to a corporate structure in accordance with the Companies Act (shareholders meetings, Representative Director, Board of Directors, Audit and Supervisory Committee, Financial Auditor) to clarify supervision of the management and execution of business and to ensure faster decision making of management and quicker business execution.

The Board of Directors of the Company is composed of three Directors (one of the Directors is an outside Director), who are not Audit and Supervisory Committee Members, and three Directors (all are outside Directors), who are Audit and Supervisory Committee Members. In addition to regular Board of Directors meetings basically held on a monthly basis, special Board of Directors meetings are held based on necessity to realize quick decision making in management. The Board of Directors executes matters that are stipulated in laws, regulations, and Articles of Incorporation of the Company, decides important matters related to management, and supervises the execution of operations by each Director.

The Board of Directors, chaired by CEO Riku Tazumi as head of the body, is composed of Director Shinya Tsurui and Director Takeyuki Aritomi, who are not Audit and Supervisory Committee Members, and Director Shunsaku Maekawa, Director Tasuku Yamaoka, and Director Yuko Maruyama, who are Audit and Supervisory Committee Members. Takeyuki Aritomi, Shunsaku Maekawa, Tasuku Yamaoka, and Yuko Maruyama are outside Directors.

In regard to candidates for Directors (who are not Audit and Supervisory Committee Members), the Company nominates the best-qualified persons with the capability to fulfill the job duties and responsibilities through consideration of the personalities, knowledge, and other elements of the candidates. The candidates for Directors (who are not Audit and Supervisory Committee Members) are decided by a resolution of the Board of Directors, the majority of which consists of independent outside Directors.

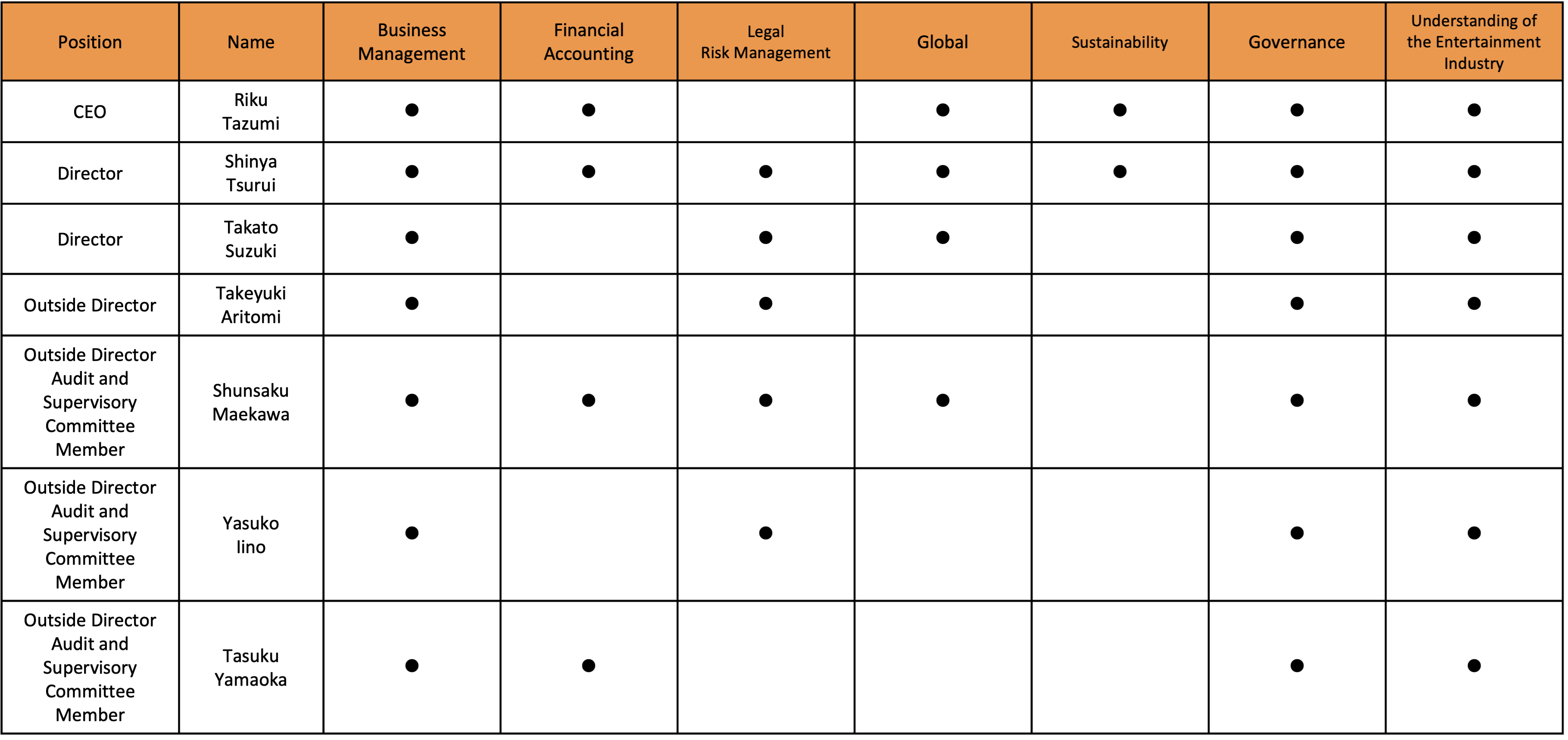

◆ The Skill Matrix of Directors

The Company sets the composition of the entire Board of Directors so that it can provide appropriate management direction and operate a full supervisory function to deal with the business environment and management issues in order to promote the Company’s sustainable growth and enhance its corporate value over the medium to long term. Currently, the skills of individual directors are appropriately balanced, as shown in the table below.

◆ Policies for Decisions on Remuneration for Directors (who are not Audit and Supervisory Committee Members) and the Calculation Method

Please review our Corporate Governance Guidelines.

The Company is a company with an Audit and Supervisory Committee, and the Committee is composed of three Audit and Supervisory Committee Members (one Full-time Audit and Supervisory Committee Member. All Audit and Supervisory Committee Members are outside Directors). The Audit and Supervisory Committee monitors the approach and management status of governance at the Company and audits the performance of the job duties of Directors. In addition to the execution of legal rights such as receiving reporting from the Directors, employees, and the Financial Auditor, by attending important meetings including management meetings and other means, the Full-time Audit and Supervisory Committee Member carries out effective monitoring. Non-Full-time Audit and Supervisory Committee Members monitor management based on their work experience and from their professional perspectives. At monthly Audit and Supervisory Committee meetings, audit results carried out by the Full-time Audit and Supervisory Committee Member on a daily basis are reported, and necessary resolutions are made.

Moreover, the Audit and Supervisory Committee closely works with the Financial Auditor and internal audit staff members primarily through the exchange of information and opinions as needed with the aim of an enhanced audit function.

The Audit and Supervisory Committee is composed of Shunsaku Maekawa, Tasuku Yamaoka, and Yuko Maruyama, all of whom are outside Directors. Shunsaku Maekawa is the Chairperson of the Audit and Supervisory Committee.

The candidates for Directors who are Audit and Supervisory Committee Members are nominated in the general meeting of shareholders based on decisions by the Board of Directors after approval from the Audit and Supervisory Committee.

The Company has established a Nomination and Compensation Committee as a voluntary advisory body to the Board of Directors to further improve the Company’s corporate governance system and enhance the independence and objectivity of the Board of Directors and strengthen its accountability by obtaining appropriate involvement and advice from independent outside directors regarding the functions of the Board of Directors relating to director nomination and compensation. The Board of Directors shall select at least three committee members, a majority of whom must be independent outside directors. The Nomination and Compensation Committee is currently composed of three members: representative director and CEO Riku Tazumi, and Takeyuki Aritomi and Shunsaku Maekawa, who are both independent outside directors. It is chaired by Takeyuki Aritomi.

The Management Committee is composed of directors (including the CEO), Full-time Audit and Supervisory Committee Member and executive officers, and persons appointed by the CEO of the Company as necessary. It is held on a regular basis, at least once a week, in principle. The Management Committee deliberates on important matters related to the organization, operation, and other management of the Company to clarify the decision-making process for proposals to be submitted to the Board of Directors and ensure its transparency. The Committee also hear opinions from a Full-time Audit and Supervisory Committee Member as necessary.

The Company has entered into an audit contract with Grant Thornton Taiyo LLC and undergoes timely and appropriate audits from an independent standpoint.

The Company has introduced an executive officer system to separate management decision-making and auditing functions from business execution functions and to ensure prompt execution of business operations, and currently six executive officers (Aki Iwakura, Yosuke Kobayashi, Masato Fujita, Toshihiro Iba, Shumpei Hashimoto, Urara Ozawa) are responsible for their duties. Executive officers are appointed by the Board of Directors and perform their duties in accordance with their assigned duties. The term of office of executive officers shall be until the conclusion of the Ordinary General Meeting of Shareholders for the last fiscal year ending within one year after their election.

The Company has established an Internal Audit Office (consisting of one manager of the Internal Audit Office) to conduct internal audits of the Company. The person in charge of internal audit conducts an internal audit for the purpose of verifying the appropriateness of the business and ensuring the effectiveness and efficiency of operations, reports the audit results to the CEO, and makes suggestions to each audited department to improve operations, etc., and later follows up and confirms the status of improvement. Also, the person in charge of internal audit enhances the effectiveness of audits by exchanging information and opinions with the Audit and Supervisory Committee and the accounting auditors as needed.

In order to develop and fully implement a compliance system and appropriate governance, the Company has established a Compliance Committee consisting of directors, corporate auditors, the manager of business administration, and employees in charge of compliance in each department. The Compliance Committee holds its regular meeting once a quarter to discuss the status of the development and operation of the compliance system and internal control system.

We have established risk management rules to strengthen the risk management system throughout the Company with the aim of preventing the emergence of risks that cause physical, economic or credit losses or disadvantages to us and minimizing our losses. All employees, including the Representative Director and CEO, directors, and executive officers, actively foresee and evaluate business risks, make timely reports to the Board of Directors, the management meeting and the Representative Director and CEO so that a system is in place that enables us to respond appropriately and promptly as a company.

As a system to ensure proper business execution, the Board of Directors of the Company passed a resolution to determine the “Basic Policy for the Establishment of an Internal Control System” and the Company is currently operating an internal control system based on the basic policy. The outline is as follows:

- System to ensure that the execution of duties by directors and employees complies with laws and regulations or the Articles of Incorporation.

- The Board of Directors shall be composed of at least one-third of all directors, with independent outside directors to strengthen the supervisory function.

- The Nomination and Compensation Committee shall be established as an advisory body to the Board of Directors to ensure the effective functioning of corporate governance initiatives.

- Compliance rules shall be established to ensure that the Company and its officers and employees comply with laws, regulations, and the Articles of Incorporation and are able to behave in a manner that respects ethics.

- The Company will monitor the functioning of the compliance system by establishing a system that allows to report directors’ violations of laws and regulations through the Company’s compliance-related whistle-blower system.

- The secretariat of the Board of Directors will be set up (1) to enable a system by which the Board of Directors meetings are held promptly as necessary so that matters stipulated in the Board of Directors Meeting Agenda Standards are submitted and discussed in a timely manner, and (2) support the preparation of materials that allows sufficient deliberation of proposals at the Board of Directors meetings and provide advance explanations of the contents of proposals, thereby facilitating understanding of proposals by outside directors and corporate auditors and ensuring appropriate confirmation of legality and other aspects of the proposals.

- If a director discovers any violation of laws, regulations or the Articles of Incorporation by other directors, he or she shall immediately report it to the Audit and Supervisory Committee and the Board of Directors.

- System for retention and management of information concerning the execution of duties by directors

Information concerning the execution of duties by directors shall be appropriately recorded, stored and managed in accordance with the document management rules and information security management rules. - Rules and other systems for managing the risk of loss

- The Company shall establish risk management rules that systematically define the Company’s risk management, and establish and operate a risk management system based on these rules.

- The person in charge of internal audit shall audits the risk management status of each organization and reports the results to Representative Director and CEO.

- System to ensure that the duties of directors are performed efficiently

- The Board of Directors shall promote prompt and efficient processing of business execution based on decisions made by the Board of Directors by clarifying the system of responsibility for business execution and business processes through the establishment of the rules of the Board of Directors, rules of administrative authority, rules for the division of duties, and rules on approval procedures, etc.

- As a system to ensure the efficient execution of duties by directors, in addition to regular monthly meetings of the Board of Directors, meetings consisting of the majority of directors are held as needed to determine basic policies and strategies.

- System to ensure that the execution of duties by employees complies with laws and regulations and the Articles of Incorporation.

- Employees perform their duties based on the organization and division of duties, etc. as determined by the Board of Directors.

- The person in charge of internal audit monitors and verifies the status of the implementation and operation of the internal control system in cooperation and collaboration with Audit and Supervisory Committee Members and accounting auditors.

- System for optimizing corporate governance in the Company and its subsidiaries

- In order to ensure the appropriateness of the operations of its subsidiaries, the Company shall provide management guidance, support, control, and, as necessary, supervision and record keeping to its subsidiaries.

- When Audit and Supervisory Committee Members finds that there is a problem or the need for improvement in the compliance system of a subsidiary, he/she may state his/her opinion at the Company’s management meeting and a Board of Directors meeting, and request the formulation and implementation of corrective measures and recurrence prevention measures.

- Audit and Supervisory Committee Members shall audit subsidiaries when necessary, and if they find any problems, they may report them to the Board of Directors and request the formulation and implementation of corrective measures and measures to prevent recurrence.

- Matters concerning an employee when the Audit and Supervisory Committee requests the placement the said employee to assist his/her duties.

- When the Audit and Supervisory Committee deemed it necessary and requested the placement, an employee to assist the Audit and Supervisory Committee in his/her duties shall be promptly placed.

- When employees to assist the Audit and Supervisory Committee are to be appointed, the number of employees, personnel transfers, performance reviews, etc., shall require the approval of the Audit and Supervisory Committee, and the selection of such employees shall be discussed between the directors and the Audit and Supervisory Committee to ensure their independence from the directors (excluding Directors who are Audit and Supervisory Committee Members).

- Systems for reporting to the Audit and Supervisory Committee and other systems to ensure that audits by the Audit and Supervisory Committee are conducted effectively

- Audit and Supervisory Committee Members selected by the Audit and Supervisory Committee shall attend meetings of the Board of Directors in order to gain an understanding of important decision-making processes and the status of business execution.

- In principle, the Audit and Supervisory Committee Members shall hold a regular meeting of the Audit and Supervisory Committee once a month, as well as extraordinary meetings as necessary, to exchange information and discuss the status of audit implementation, etc., and to receive reports on accounting audits from the accounting auditors on a regular basis and exchange opinions with them.

- Directors and employees shall report on the status of the execution of their duties and other matters as needed upon request of the Audit and Supervisory Committee.

- Upon discovery of actual violations of laws or regulations or other violations or potential violations of compliance at subsidiary companies, Directors, Auditors, and employees of the subsidiary companies shall report to the Audit and Supervisory Committee of the Company immediately. In addition, when receiving such report, the Audit and Supervisory Committee shall notify the relevant departments of the Company, understand the situation, and make recommendations on countermeasures.

- Audit and Supervisory Committee Members selected by the Audit and Supervisory Committee may confirm the minutes of Board of Directors meetings, records related to business execution, and internal requests for approval and any other important materials where managerial decisions are made.

- The Audit and Supervisory Committee shall receive reports on audit results from internal audit staff members, request investigation based on necessity, and provide specific instructions.

- In the event that any disadvantageous treatment of a person who reported to the Audit and Supervisory Committee was confirmed, the person who performed the disadvantageous treatment may be subjected to disciplinary or other actions in accordance with the employment regulations, etc.

- When the Audit and Supervisory Committee Members requests advance payment of expenses incurred, reimbursement of expenses paid, or repayment of debts incurred in the performance of his/her duties (only limited to duties related to job duties in the Audit and Supervisory Committee), the Company shall comply with the request, unless it can be proved that the expenses are not incurred in the performance of the Audit and Supervisory Committee Members’s duties.

- System for eliminating antisocial forces

- The Company’s policy shall stipulate that the Company shall resolutely confront antisocial forces and groups that threaten the order and safety of civil society from the perspective of social responsibility and corporate defense, etc.

- In case of any unreasonable demands from antisocial forces, the Company shall consult with its legal advisors in each case.

We strictly comply with all laws and rules in our business operations, carry out sincere and impartial corporate activities, and has established “Compliance Regulations” and Compliance Committee for the purpose of ensuring the soundness of management based on self-discipline. The Compliance Committee constantly works with employees of each department, the Audit and Supervisory Committee Members, and the Internal Audit Office to investigate whether all employees, including directors, are in compliance. In addition, we hold regular meetings to check the status of implementation and operation of the compliance system and internal control system, identify potential risks of violation of laws and regulations, and decide how to deal with them. In the unlikely event that a case of noncompliance should occur, a meeting of the Compliance Committee will be held in a timely manner to investigate the facts, take prompt action to minimize the damage, and take measures to prevent recurrence.